A commercial bank is a brick and mortar financial institution engaged in delivering financial services to the public, such as deposit accounts, checking accounts, loans and mortgages, business loans and basic investment instruments. The public prefer commercial banks to protect their money and in return, the banks offer interest on deposits. Institutions like Barclays Bank, ICICI Bank, Axis Bank and State Bank of India are commercial banks. Are you aware of how do banks make money? This post outline a few major income sources for commercial banks.

The purpose of this blog post in DBM is something different. But as a DBM reader, this could give some information about commercial banks and how they make money.

The purpose of this blog post in DBM is something different. But as a DBM reader, this could give some information about commercial banks and how they make money.

Major Ways How Do Banks Make Money

Quick Jump

1) Loans:

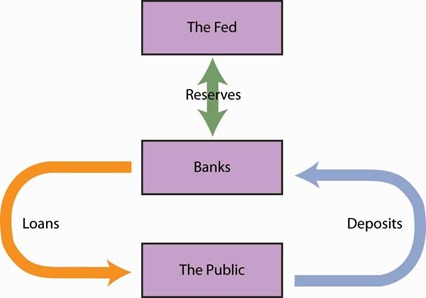

Lending loans to borrowers from the public is a major way for commercial banks to earn money. These could be personal loan, home loan, car loan and other type of mortgages.

The money lent to a person comes from the money deposits of other customers. Banks generally restrict the number of withdrawals to remain solvent, especially for forwarding loans. This ensures that the money remains within the bank.

The amount is lent to a person at a higher interest rate for a fixed period of time. As the loan amount starts getting recovered, the bank pays a portion of the interest value to other depositors and keeps the remaining as its “earning”.

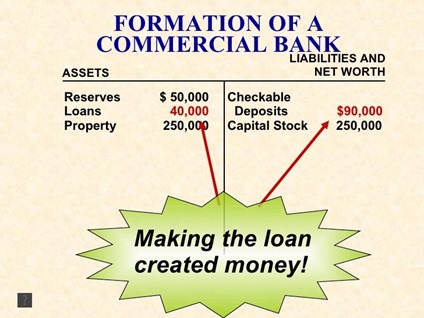

Issuance of loans creates money.

Let’s take a simple example. Person A does a fixed deposit worth 100,000 with a bank @8% annual interest for 5 years. Person B requests a personal loan worth 100,000 with the same bank.

After checking person B’s credentials, the bank decides to extend the personal loan @13% annual interest for 5 years. The 5-year loan fetches 136,518 to the bank. At the same time, the fixed deposit matures and the bank pays 121,658 to person A.

The difference between the two – 14,860 – is the bank’s income.

Read Also: How Google Adsense works, understand it well to able to make money.

2) Credit Cards:

Credit cards are unsecured loans extended by a commercial bank with the sole intention of earning heavy interest.

Availing a credit card, limited or unlimited value, gives the person access to immediate funds and the person is charged premium fees by the bank for extending this facility.

Initially, credit card issuing bank offer low late payment fees for the first year but from second-year onwards, the interest rates vary anywhere between 15% and 30%.

Often, mismanagement of credit cards by the user leads to a huge debt, which ends up in a high windfall for the bank.

3) Public Deposits

Money kept by the public in various types of savings and checking accounts is the largest source of funds for commercial banks.

The amount accountholders entrust the bank with safekeeping earns them a very basic interest amount. These deposits are pooled together and loaned out to other individuals or invested elsewhere.

The banks earn interest money and share the basic percentage with the savings or checking account holder.

4) Debt Issuance

Commercial banks often issue debts to raise capital. This is done to maintain smooth banking operations and when the need arises; the banks will use sources like repurchasing agreements to access debt funding.

The issuance of bank bonds isn’t unusual but they aren’t a common source of issuing bank capital also; the bank bonds are either convertible or callable in nature. The ‘debt’ forms a small percentage of total loans in commercial banks and they aren’t major loanable funds either.

5) Service Fees

Commercial banks levy service fees on its customers and even though the service fees are marginal, it forms a large chunk of commercial bank earning medium.

Commercial banks charge service fees for ATM’s, overdrafts, operating a simple savings account, issuing debit cards, renewing debit cards, accessing internet banking and mobile banking, issuing checks, maintaining bank lockers and more.

These fees are unavoidable since every commercial bank charges them.

In short, How do banks make money? the commercial banks make money through deposits and loans.

Endnote

Commercial banking isn’t free. It’s a business which earns from the masses, the accountholders and since almost every person has a bank account, these ways turn into a honey pot of profits for the banks.

This is a guest post from Avadhut who runs an excellent blog to help you, the finance career aspirant, become intelligent, independent and successful in your finance and investment career

Loans….they use it for funding Companies….that circle !

HI DINESH BHAI,,,,

I READ YOUR BLOG AND I FOUND YOUR BLOG REALLY INTERESTING. I HAVE CREATED A ALSO MUSIC BLOG,, AND I WANT YOUR SUGGESTION ABOUT MY BLOG,, I ALSO WANT EARN LIKE YOU ARE EARNING. SO PLEASE LOOK AT MY BLOG AND CONTENT AND SUGGEST ME THE RIGHT WAY….